Some of our outstanding losers, Citigroup, is coming back to life. Amazingly enough. DJIA is up 2.28% , NAZ is up 2.74%!

Amazing considering latest statistics coming out of japan:

In Japan it was reported that "."..wholesale prices fell a record 6.6 percent in the year to June, as the world's No.2 economy slides deeper into deflation"

If deflation is making markets go up, then productivity increases can`t be far behind. Whoever has a job will have to spend their cash for the rest of the unemployed (yeah right)...

Oh well enjoy it while it lasts!

Wednesday, July 15, 2009

Monday, July 13, 2009

You know you are in trouble when....

Good morning to all on this Monday July 13th 2009!

This week is banking releases for the big boys

Today two observations:

A)Meredith Whitney

The lady was on CNBC earlier this morning and probably the talk of the day as she raised her estimates on GS which are already 30% over street consensus. The stock hit a low of $50 now trading over $146. A bit late there on the call Mam!

Whitney also said that net tangible at BAC gave a value to the stock over $12. Making it one of the cheaper big banks out there. Yup owning a portfolio in California is really a great idea this week... NOT!

She also mentioned that Citi was a dead duck with the dilution having killed any chance of a rebound!

B)Paul Volcker

The only man in the BAM administration who can bring real reform and change is nowhere to be seen these days. This is truly a bad omen. If you let technocrats like Geithner and Bernanke to skip stones from one crisis to the next,we are in for a bigger fall! Instead the admin is bent on serving rhetoric of more legislation to plug holes in a system that does not work and only delay the inevitable.

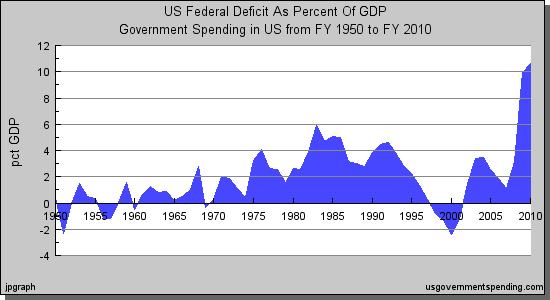

We cannot understand why Health care reform is being pushed down the throats of legislators when the finances of the country are in such disarray. Sound to us like buying a very expensive engine when you can't afford to fill up the tank!

We strongly hope that Mr. Volcker doesn't give up and is able to convince enough idealists that NOW is the BEST time to fix the system while there is still goodwill behind the US dollar ( or is that ill will behind the Euro?)

You know when you are in trouble when analysts are bullish on stocks that have tripled off their lows and reformers are pushed aside in favor of populist rhetoric.

We are still short S&P as we expect earnings to dip 15% across the board

Good trading to you

DCW

This week is banking releases for the big boys

Today two observations:

A)Meredith Whitney

The lady was on CNBC earlier this morning and probably the talk of the day as she raised her estimates on GS which are already 30% over street consensus. The stock hit a low of $50 now trading over $146. A bit late there on the call Mam!

Whitney also said that net tangible at BAC gave a value to the stock over $12. Making it one of the cheaper big banks out there. Yup owning a portfolio in California is really a great idea this week... NOT!

She also mentioned that Citi was a dead duck with the dilution having killed any chance of a rebound!

B)Paul Volcker

The only man in the BAM administration who can bring real reform and change is nowhere to be seen these days. This is truly a bad omen. If you let technocrats like Geithner and Bernanke to skip stones from one crisis to the next,we are in for a bigger fall! Instead the admin is bent on serving rhetoric of more legislation to plug holes in a system that does not work and only delay the inevitable.

We cannot understand why Health care reform is being pushed down the throats of legislators when the finances of the country are in such disarray. Sound to us like buying a very expensive engine when you can't afford to fill up the tank!

We strongly hope that Mr. Volcker doesn't give up and is able to convince enough idealists that NOW is the BEST time to fix the system while there is still goodwill behind the US dollar ( or is that ill will behind the Euro?)

You know when you are in trouble when analysts are bullish on stocks that have tripled off their lows and reformers are pushed aside in favor of populist rhetoric.

We are still short S&P as we expect earnings to dip 15% across the board

Good trading to you

DCW

Thursday, July 2, 2009

USA = 40 Millions people without jobs

ECONOMIC REALITY

AS the graph shows, US unemployment is racing towards 10% without flinching.It is going to be tough to get these people back to work if factories are working at 2/3 of capacity. We have explained repeatedly that this economy which went from a zero savings rate now climbing to a 5-10% rate is on the mend. This will be a long and protracted process and to think that you can pick stock winners in this environment is wishful thinking.

Add to that that hourly wages are flat and there is no impetus to increased discretionary spending if not for governments unwise spending spree. The US (Germany and Italy are in the same boat) like Japan before it has to contend with an aging population. Older people always spend less. No more expense accounts, employer sponsored plans. The gravy train stops. The sooner the government learns its lesson the better for all!

FOR INVESTORS

Asset allocation and currency holdings if anything is much more important and the timing of the conversions is crucial!

We repeat out themes:

1)We have told you that oil prices were untenable. Anything over $70 was caused by banks and speculators using free cash to hoard. That was unwise and it will show up by year end as a loss fro anyone buying over $70.

2)Gold is not a refuge in a deflation era.

3)S&P short is your best asset allocation until employment stabilizes

It is foolish to listen to pundits saying that employment is a lagging indicator. In Deflationary times it is in fact a leading indicator...

Subscribe to:

Posts (Atom)