Rarely can One pundit utter this phrase of enlightenment but we think we have a pretty good sense of where the markets are heading in the NEXT FOUR weeks...

US FEDERAL DEBT YIELDS

Like most people we knew this day would come, maybe later in the year , but it was coming... It was not a question of if but when and today March 24th, 2010 the market started to balk at yet another massive treasury issue. The government's auction of $42 billion in 5-year notes went poorly, pressuring an already sagging Treasury market and driving yields higher and Thursday issue of the 7 year notes will show the same thing as today...

So the first conclusion is if the 5yr NOTES is MOVING UP , the SEVEN YEAR won't be far behind ALL the WAY to the 30 year...

The FED has announced the end of March for buying MBS... so in effect Quantitative easing is going to be seriously curtailed

SO FIRST TAKE AWAY: FED TIGHTENS CREDIT AND US LONG RATES WILL MOVE BEFORE THE FED MOVES ON RAISING RATES

CURRENCIES

↓EURO: We still believe that the Euro is going towards USD parity but first it will have to go through 1.20... We have seriously complained about the undue interest in Greece knowing too full well that this is the least of the European union's problems. Everybody will soon realize that no partner nation can leave the union and like all bad marriages, there are still of lot of noise, demonstrations etc. to come out of Portugal and the unemployed Spaniards... There will be at least another 12 months of pressure on the EURO

↓YEN: Japanese traders will go for the carry trade chasing US raising rates, so the YEN WILL FALL VS THE USD in 2010 but EXPECT this in the JUNE to SEPTEMBER PERIOD

↓CDN: We believe commodities are going to move sideways if not lower in the next two years so the Canadian dollar is going to retrace towards 90 cents...

↓AUD & NZ: WE think tightening in China is going to put Chinese commodity buyers and these currencies will be under pressure vs the greenback...

COMMODITIES

↓PRECIOUS METALS With all these rates and currencies gyrations , we have become extremely BEARISH on ADDING TO GOLD POSITIONS HERE. We think that a rate rises in US RATES ON the LONGER END will have traders leave GOLD and ESPECIALLY SILVER to look for rising yields in carry trades. GOLD IS going to be below 950 in the next TWO years

↓METALS: We believe CHINA will be more interested in securing MINING rights over taking delivery. So you can expect some companies that fail to deliver their earnings forecast to be subject to takeovers...

↔OIL and NG. We see Oil trading in a range of 68-82 for the next two years. NG at $4.00 is pretty much at the bottom range and the summer should see it rebound.

↑FOOD: We think that as a basket this is still the best place to invest.

INDICES

↑DJIA will defy pundits and still has 100-250 points to the upside UNLESS FED moves rates 100 BPS (VERY unlikely)

↓TSX: with some commodities about to seriously correct, AVOID

↓NIKKEI: With Carry trades out of the yen and lousy export picture the Nikkei may not be your favorite market for now

↓SHANGHAI: With the central bank tightening, this will a picker's market but the indices will retrace

In conclusion, From Oct 11 2007 when the S&P 500 hit 1576.09 to March 6th 2009 saw the S&P 500 low of 666. That was a 57.7% retracement from the 2007 highs. THE SECOND worse drop. By march 2010, helped with the largesse of Washington yet backed by the taxpaying public, the FED and its free money policies have largely concentrated powers into fewer hands. The market is now around 1167 and the party is pretty much over.

From a rising tide to save a quasi bankrupt banking system, we now have to contend with FED tightening and many bets out there are about to face the reality that NOT ALL countries (or banks) will survive. The US is leading the way with banking reform and the next few weeks will give us a good indication on the NEW pricing of RISK Hold and wait won't work in this market and if you don't keep a tight lid on erosion the rest of the year will have you fighting the tape at every bump in the road!

Good trading to you!

DCW

Thursday, March 25, 2010

Tuesday, March 2, 2010

Beware the Ides of March or a missive full of really bad analogies

Actually the equity market are pretty much set to keep their gains! March hope springs eternal.

Our answer is simple: Doubtful for a retreat over the next two months but Mid May to End of June should see the FED start to really try to reignin free money... Right now the perfect wave is allowing Dr. Bernanke to shine as a savior surfer and surf away in an idyllic setting. The fact that three board seats are still available at the FOMC must have something to do with it. It's 4:30PM and the sun is setting soon enough! Best be ready for a cold summer shower and some drinks!

We are more sanguine about commodities, especially food and energy, in the equity markets at this juncture. There are so many bids on the US dollar at this moment, this pig with lipstick is going to be the prom queen at the June graduation.

CURRENCIES

But like any commodity, when demand for US dollars surpasses supply, you are going to have dollar bulls saying all is well. Until the recent flood of new paper really hits the borrowers, it will be like an iceberg falling in the Jacuzzi. It always brings to mind the famous scene in the Titanic when Jack tries to stay on the doomed ship the longest time possible because he bloody well knows any time spent in the frigid waters of the North Atlantic will be the death of him and the Mrs. (please pronounce in a Scottish rogue for comedic effect). Ask Iceland bank shareholders if they have an opinion on the matter. So right now traders and old investors are moving to the top floor of this deck of wet cards using the US dollar as the quickest way to avoid a floundering pound and a Euro trading at a 10 month low. Is that wise? Gold in Euro terms always seem to us as the right move when pointed out by Dennis Gartman.

So if you don't like the analogies of cold/hot showers, jacuzzis and Icebergs... bare with us we only have one more. In the world of international finance, the sharks are now circling the easier prey that can be easily isolated. Take for example the GBP. Start with some juicy gossip about tyrant PM Brown, add a dash of bad economic data and voila,,, le disaster du jour with a Cherry-o on top!

The Euro is the most overplayed story with Greece playing the eternal insouciant profligate ingenue... a $40BB check from the rich German uncle should be forthcoming if enough mea culpas are proffered... ( sorry don't know the Greek translation to Mea Culpas).

The Italians continue business as usual but our bets are still with Spain and its terrible economic situation. So the Euro will stabilize here but we believe on the next leg down it may hover near parity to the USD.

The Europeans will quickly understand that if the Euro falters there will be no growth for quite some time and they will start to import inflation.

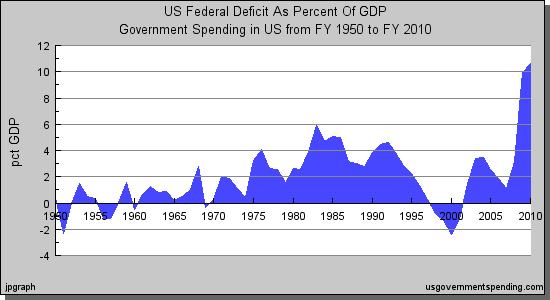

In the US, the government continues to dole out projects and expenditures are out of control. The real economy is masked by Uncle Sam projects of dubious value. I We are not sure the Pentagon expenditures fit in as infrastructures projects. Rebuild America! right, with bombs, Humvee s, Aircraft carriers and drone planes? Did I ever mention the expression one-term President?

WHAT to DO

We suggest you do a very strong Spring cleaning, push the outlook 5 years from now, wasn't owning Exxon, Intel, Petrobras and Nestle and other large well capitalized companies remains a much wiser choice that some NASDAQ darling with earnings "visibility" which is actually zigzagging pretty close to a precipice? Make sure all those stop losses are in there.

BUT PLEASE follow our advice and dump those US dollars for gold bars.!

THE REST OF THE YEAR ( for numerologists)

This sure has the feel of 1987 all over again... Stratospheric P/Es, rising rates and an ever shrinking pot to ...

In 1987, we sold everything in May, Took three months off in Greece ( of all places!), came back in September and hearing snickering remarks until that faithful day in October... The years ending in Os don't' do very well... need I remind you 1930 ( great depression), 1980 (Iran Crisis, NY default,,, etc.), 2000 Tech bubble burst aftermath, isn't 2010 just a repeat with the inconvenience of a bunch of technocrats hell bent on trying to keep alive a patient with no quality of life ( or job for that matter).

BUT PLEASE follow our advice and dump those US dollars for gold bars.! ( repeated for serious effect)

Meantime I am buying dinner to anyone who can call the low on US treasuries... been waiting so long I have dust on my buy tickets... TBT and the likes!

Good trading to you

Our answer is simple: Doubtful for a retreat over the next two months but Mid May to End of June should see the FED start to really try to reignin free money... Right now the perfect wave is allowing Dr. Bernanke to shine as a savior surfer and surf away in an idyllic setting. The fact that three board seats are still available at the FOMC must have something to do with it. It's 4:30PM and the sun is setting soon enough! Best be ready for a cold summer shower and some drinks!

We are more sanguine about commodities, especially food and energy, in the equity markets at this juncture. There are so many bids on the US dollar at this moment, this pig with lipstick is going to be the prom queen at the June graduation.

CURRENCIES

But like any commodity, when demand for US dollars surpasses supply, you are going to have dollar bulls saying all is well. Until the recent flood of new paper really hits the borrowers, it will be like an iceberg falling in the Jacuzzi. It always brings to mind the famous scene in the Titanic when Jack tries to stay on the doomed ship the longest time possible because he bloody well knows any time spent in the frigid waters of the North Atlantic will be the death of him and the Mrs. (please pronounce in a Scottish rogue for comedic effect). Ask Iceland bank shareholders if they have an opinion on the matter. So right now traders and old investors are moving to the top floor of this deck of wet cards using the US dollar as the quickest way to avoid a floundering pound and a Euro trading at a 10 month low. Is that wise? Gold in Euro terms always seem to us as the right move when pointed out by Dennis Gartman.

So if you don't like the analogies of cold/hot showers, jacuzzis and Icebergs... bare with us we only have one more. In the world of international finance, the sharks are now circling the easier prey that can be easily isolated. Take for example the GBP. Start with some juicy gossip about tyrant PM Brown, add a dash of bad economic data and voila,,, le disaster du jour with a Cherry-o on top!

The Euro is the most overplayed story with Greece playing the eternal insouciant profligate ingenue... a $40BB check from the rich German uncle should be forthcoming if enough mea culpas are proffered... ( sorry don't know the Greek translation to Mea Culpas).

The Italians continue business as usual but our bets are still with Spain and its terrible economic situation. So the Euro will stabilize here but we believe on the next leg down it may hover near parity to the USD.

The Europeans will quickly understand that if the Euro falters there will be no growth for quite some time and they will start to import inflation.

In the US, the government continues to dole out projects and expenditures are out of control. The real economy is masked by Uncle Sam projects of dubious value. I We are not sure the Pentagon expenditures fit in as infrastructures projects. Rebuild America! right, with bombs, Humvee s, Aircraft carriers and drone planes? Did I ever mention the expression one-term President?

WHAT to DO

We suggest you do a very strong Spring cleaning, push the outlook 5 years from now, wasn't owning Exxon, Intel, Petrobras and Nestle and other large well capitalized companies remains a much wiser choice that some NASDAQ darling with earnings "visibility" which is actually zigzagging pretty close to a precipice? Make sure all those stop losses are in there.

BUT PLEASE follow our advice and dump those US dollars for gold bars.!

THE REST OF THE YEAR ( for numerologists)

This sure has the feel of 1987 all over again... Stratospheric P/Es, rising rates and an ever shrinking pot to ...

In 1987, we sold everything in May, Took three months off in Greece ( of all places!), came back in September and hearing snickering remarks until that faithful day in October... The years ending in Os don't' do very well... need I remind you 1930 ( great depression), 1980 (Iran Crisis, NY default,,, etc.), 2000 Tech bubble burst aftermath, isn't 2010 just a repeat with the inconvenience of a bunch of technocrats hell bent on trying to keep alive a patient with no quality of life ( or job for that matter).

BUT PLEASE follow our advice and dump those US dollars for gold bars.! ( repeated for serious effect)

Meantime I am buying dinner to anyone who can call the low on US treasuries... been waiting so long I have dust on my buy tickets... TBT and the likes!

Good trading to you

Subscribe to:

Posts (Atom)