We covered all our short bonds at this point. WE are short 138% on S&P though!

While we told you on June 10 that long equities was becoming a suspect strategy, we now also think that shorting bonds is a VERY dangerous move.

We think the USD dollar can hit 1.17 vs. the Canadian. Why? The risk capital played the same game. Piling into commodities as if that was going to save the day. Was copper in such short supply? Oil back over $90 as Goldman was expounding looking for suckers?

As we have repeated many times for the last couple of months, that is not a panacea for all the troubles out there but they all point to deflation created by US monetary policy. The result is abysmal job numbers, month after month. IN FACT THERE IS NO JOB CREATION AND THE SITUATION IS GETTING WORSE. In a world where the consumer de-leverages governments can and should help induce investment not belabor the process by introducing legislation to regulate! WAKE UP! CREDIT CARDS DEFAULTS ARE DOUBLING Q/Q

Deflation, Deflation, Deflation. As long as the Fed doesn't decide to FORCE banks to loan money ( by raising rates) nothing is going to happen EITHER WAY. The day will come though. Rates will start to rise followed by a massive influx of money and inflation is just going to explode. NOBODY out there says it but the RISING of rates will CREATE inflation. WHO would have thunketh?

Meanwhile back at Medieval Camelot, King Obama and his Google eyed knights of the info-techno age are still looking at their rear view mirror and looking at a charging T-REX or Dragon, light on economic data, and relying on data points to draw feeble insights of dead green shoots (clearly though a persistent housing bust is omnipresent ) and think that lower LONG term rates is where lies their salvation. To us it looks like a money pit full on cancerous deadbeat brokers and third rates bankers but that's a story for another day!

Sorry boys, but while you are avoiding the marching T-TEX you just MISSED a giant curve and falling down a steep embankment where the T-REX will get you anyway!

So expect the dollar to rise, bonds to squeeze out the shorts and Obama to think he is doing well. He is in a no win situation vs Bernanke's reappointment!

1) If he reappoints him, Bernanke won't raise rates (extending deflationary period)

2) If he replaces him with Geithner ( he won't rise rates looking as long bonds yields as the NEW role of the fed)

BRING BACK CAPITALISM

Salvation lies probably in boutiques bank shops welcoming the real rainmakers of years past but also newly minted players of tomorrow.

What the economy needs now is for the government to STOP being the buyer of worthless equity and a salvage crew of carrion. GET OUT OF THE WAY!

RISK takers must be FREE to take risks, not regulated on pay. As long as Communists run US capital ... it's better to let sleeping dogs lie or a Chinese dragon rampage can be your next full living nightmare! YOU'VE BEEN WARNED!

We are staying short equities and LONG USD.

Good trading to ya!

DCW

Monday, June 22, 2009

Wednesday, June 10, 2009

Deflation... it's all down hill from here ... Just be happy it's still a W and not a flatliner

ANY ASSET DENOMINATED in USD IS TOXIC

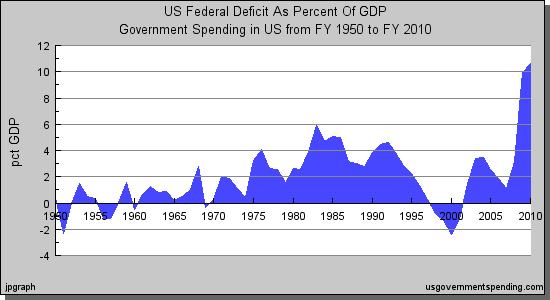

It is so foolish to think that because the US wrote up 13 Trillion dollars of IOUs that a massive wave of inflation was coming! The planet already lost $50 trillion. Inflation is not the cause for concern, it 's deflation and countries who can't pay their debts!

People are just going to stop trading with the USA until they get their house in order and they will let rates rise until it does. The USD will rocket up while people expect it to go down.

Meantime short some mortgage institutions because 50 cents on the dollar is still not a good price. Banks are going to fail because mortgages will fail faster than the income can be generated by the interest spread. Mortgages renewals cannot be supported by the Treasury or the Fed.

COMMODITY RALLY is FOR THE BIRDS

Fools are playing the Commodity game trying to figure out what China will buy. The special du jour: Gold, Copper, Oil , Nat gas... There is no sustainable consumption numbers that justify another round of hoarding and speculation.

By the end of the year, only positions in US will show gains while EURO, HUANs, Rubles etc. will show declines...

The same happened to gold in 2007-2008... European holders got whacked holding the metal.

Why just not short US indices and avoid gyrations and tensions?

BEST BET SHORT S&P 500

Bonds are getting close to our target of 4.50-5.00%

You are better to short the S&P because 930 is a now a beacon for the shorts.

The US economy just had a modicum of recovery because inventories were seriously depleted. Don't confuse that with a recovery .. the economy will run at 60% of its heyday for quite a while... Profits will tank and we will test news lows soon enough!

We raised 50% in cash today!

Good trading to you!

DCW

It is so foolish to think that because the US wrote up 13 Trillion dollars of IOUs that a massive wave of inflation was coming! The planet already lost $50 trillion. Inflation is not the cause for concern, it 's deflation and countries who can't pay their debts!

People are just going to stop trading with the USA until they get their house in order and they will let rates rise until it does. The USD will rocket up while people expect it to go down.

Meantime short some mortgage institutions because 50 cents on the dollar is still not a good price. Banks are going to fail because mortgages will fail faster than the income can be generated by the interest spread. Mortgages renewals cannot be supported by the Treasury or the Fed.

COMMODITY RALLY is FOR THE BIRDS

Fools are playing the Commodity game trying to figure out what China will buy. The special du jour: Gold, Copper, Oil , Nat gas... There is no sustainable consumption numbers that justify another round of hoarding and speculation.

By the end of the year, only positions in US will show gains while EURO, HUANs, Rubles etc. will show declines...

The same happened to gold in 2007-2008... European holders got whacked holding the metal.

Why just not short US indices and avoid gyrations and tensions?

BEST BET SHORT S&P 500

Bonds are getting close to our target of 4.50-5.00%

You are better to short the S&P because 930 is a now a beacon for the shorts.

The US economy just had a modicum of recovery because inventories were seriously depleted. Don't confuse that with a recovery .. the economy will run at 60% of its heyday for quite a while... Profits will tank and we will test news lows soon enough!

We raised 50% in cash today!

Good trading to you!

DCW

Subscribe to:

Posts (Atom)